Turkey Bans Wheat Imports till October

Turkey bans wheat imports from June 21 to October 15, 2024, impacting global markets and increasing competition among EU exporters. Learn more about the implications for wheat prices and trade.

Turkey Bans Wheat Imports till October

In a surprising move, Turkey has recently announced a ban on wheat imports, mentioning worries over the great safety of imported wheat. Last week, the Turkish authorities declared that it's going to ban importing wheat into the nation beginning on June 21 and continuing it until at least October 15. This has accelerated the strain on the arena wheat market, specifically on wheat prices in Europe. This choice has sent shockwaves through the worldwide wheat market, and plenty are questioning what this means for Turkey and other foremost wheat-exporting international locations, which includes those in the European Union (EU).

To defend Turkey's farmers from rate reductions and other adverse outcomes at some stage in this year's harvest, the Turkish Agriculture Ministry formally declared that it would suspend and ban wheat imports from June 21 to mid-October. “To meet the supply of raw materials needed for our exports from domestic production, to ensure that markets remain in favor of producers, and to stop our producers from being impacted by price reductions due to supply density during the harvesting period,” the ministry stated that the measures would be put into place.

How Turkey's Policy Shift Impacts Russia, the Leading Wheat Supplier?

The largest supplier and exporter of wheat to Turkey, Russia, will be most affected by the policy. Wheat prices have risen recently because Russia, the world's largest wheat exporter, anticipates somewhat lower production and export amounts in the 2024–25 marketing year. Turkey's first estimate for its 2024 crop production, released just as the wheat harvest is beginning, places the country's wheat output at 21 million tons, a 4.5% drop from the previous year. It is predicted that this year's total grain production will drop by 5.4%.

Increased rivalry for EU wheat exports following Turkey's ban?

Last week, the Turkish government declared that it will no longer be importing wheat into the nation starting on June 21 and continuing until at least October 15. This has increased the pressure on the world wheat market, especially on wheat futures in Europe. See yesterday's Market Report for further information on the current market trend. The prohibition aims to shield Turkey's local wheat producers from harvest pressure-related drops in world prices. However, the worldwide market can be affected by the prohibition as well. The ban on wheat imports from Turkey means that EU wheat exporters will now have to look for new markets to sell their products. This could lead to increased competition among European wheat producers, as they try to secure deals with other countries. Additionally, the ban may result in a surplus of wheat within the EU, putting further pressure on prices.

How will this ban Impact Wheat Prices in the EU?

With the ban on Turkish wheat imports, we can expect to see fluctuations in wheat prices within the European Union. The increased competition among EU wheat exporters may lead to a drop in prices as producers try to offload their surplus stock. On the other hand, if new markets are not found quickly, prices could potentially rise due to decreased demand.

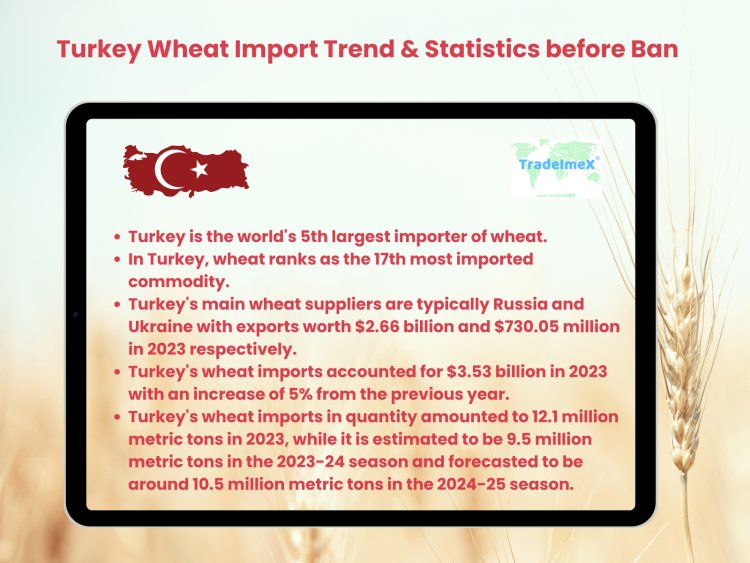

Turkey's Wheat Import Trends and Statistics Before Ban

Turkey imported 6.45 million tons for the first seven months of the 2023–2024 season (June 2023–January 2024), with 5.33 million tons (83%) coming from Russia. An additional 0.89 Mt (14%) originated in Ukraine. Russia ($2.66 billion), Ukraine ($730.05 million), Kazakhstan ($53.64 million), Moldova ($32.79 million), and Syria ($17.28 million) are the top five countries from which Turkey imports wheat. Turkey imports 10.0 Mt of wheat annually on average, placing it among the top five global importers of wheat.

Impact on the market

Along with sales by speculative traders, stronger competition from Russian wheat was a major factor in driving down wheat prices in the first few months of 2024. Due to the obstruction of commerce through the Suez Canal and the high availability of Russian exports, additional Black Sea grain was searching for homes in important European export markets. Due to Turkey's ban on wheat imports, established EU export markets may see an increase in competition from Russian and Ukrainian wheat. This effect, however, depends on whether domestic manufacturing and storage levels for Turkish wheat exports are maintained. Regarding crop sizes in Russia and Ukraine, there is also a warning. Reduced exportable levels overall and a smaller harvest for these leading producers could counteract the effects caused by the Turkish ban. Due to Turkey's decision to ban wheat imports until mid-October, the price of Russian wheat exports has decreased. Because of worries that Turkey's import ban will reduce demand worldwide, European wheat prices also declined.

The Future of the Global Wheat Market

The implications of Turkey's ban on wheat imports are somewhat distance-attaining and complex, with demanding situations and possibilities for wheat-producing countries globally. In a long time, Turkey's choice to ban wheat imports could have a lasting impact on the worldwide wheat marketplace. Only time will tell what the real outcomes of this selection might be, however, one aspect is apparent: the world of wheat exports is in for a large evolution.

Conclusion

Turkey's ban on wheat imports has sent shockwaves around the globe and through the European wheat marketplace, creating more export opposition for EU wheat manufacturers. As they scramble to discover new markets and adapt to converting dynamics, the industry is poised for a duration of uncertainty. However, this ban also underscores Turkey's commitment to enhancing its agricultural region and securing a stable food supply for its population.

What's Your Reaction?