What are the top 10 biggest Mexico exports to US in 2023-24 ?

Explore the latest statistics on Mexico's exports to the US. In 2023, Mexico's exports to the US accounted for $480.08 billion with a 5% increase from the previous year.

What are the top 10 biggest Mexico exports to the US in 2023-24?

Mexico's exports to the US accounted for $480.08 billion in 2023. Vehicles are the biggest US imports from Mexico worth $130.03 billion in 2023 followed by electrical machinery and nuclear reactors. Mexico is the biggest Trade partner of the US. According to the latest data, Mexico exported goods to the US worth $120.94 billion in the first quarter of 2024.

Current Statistics on Mexico’s Exports to the US for 2024

In the first quarter of 2024, Mexico's exports to the US totaled $120.95 billion, an increase of 1.7% from the previous year. In March 2024, U.S. exports fell 1.2% year over year while U.S. imports from Mexico increased 3.8% year over year. For the month, the United States and Mexico had a $39.7 billion trade deficit. In March 2024, automobiles ($4.2 billion), auto components ($3.2 billion), computers ($2.8 billion), commercial vehicles ($2.7 billion), and insulated wires/cables ($1.4 billion) were Mexico's top five exports to the United States.

The top 10 biggest Mexico exports to the US in 2023 includes:

1. Vehicles: $130.03 billion

Mexico's export of vehicles to the US has seen considerable growth, with a wide range of cars, trucks, and SUVs being shipped across the border in 2023. The HS Code of Vehicles is 8703.

2. Electrical Machinery: $85.55 billion

Another essential component of Mexico's exports to the US is electrical machinery. Mexico has made significant investments in the production of electrical equipment to the US. The HS code for electrical machinery is 8530.

3. Nuclear Reactors: $81.61 billion

Mexico's nuclear energy sector has been growing steadily, with the export of nuclear reactors and components playing a vital role in the country's trade with the US. The HS code for nuclear reactors and machinery is 8401.

4. Mineral Fuels and Mineral oils: $25.02 billion

In 2023, Mexico's export of mineral fuels and oils has continued to be a crucial aspect of the bilateral trade relationship between the two countries. The HS code for mineral fuels and oils is 27.

5. Optical, measuring, medical, or surgical instruments: $22.33 billion

Mexico's export of optical, measuring, medical, and surgical instruments to the US has been on the rise in 2023. The HS code for optical, measuring, medical, and surgical instruments is 9031.

6. Furniture, bedding, and mattresses: $13.35 billion

In 2023, Mexico's export of furniture, bedding, and mattresses to the US has continued to grow, reflecting the high quality and affordability of Mexican-made products. The HS code for furniture, bedding, and mattresses is 9403.

7. Beverages, spirits, and vinegar: $11.75 billion

Mexican beverages, spirits, and vinegar have gained popularity in the US market, contributing to Mexico's export success in 2023. The HS code for beverages, spirits, and vinegar is 22.

8. Commodities not elsewhere specified: $10.91 billion

Mexico's exports to the US in 2023 are not limited to specific industries but encompass a wide range of products classified as commodities not elsewhere specified. The HS code for this commodity is 99.

9. Edible fruit and nuts: $10.86 billion

Mexico is also a significant exporter of edible fruits and nuts to the US. The HS code for edible fruits and nuts is 0801.

10. Edible vegetables, certain roots, and tubers: $9.52 billion

Mexico's export of Edible vegetables, certain roots, and tubers to the US has continued to grow, catering to the increasing demand for healthy and natural foods in the US market. The HS Code for Edible vegetables, certain roots, and tubers is 07.

Key Market Insights of Mexico exports to the US

- Mexico total exports

Mexico exported goods worth $592.99 billion around the world in 2023 with an increase of 3% from the previous year 2022.

- The US is Mexico’s biggest trade partner

The US is Mexico’s biggest trade partner importing goods worth $480.08 billion from Mexico in 2023.

- Mexico’s biggest exports to the US

Vehicles are the biggest exported commodity by Mexico to the US worth $13.03 billion in 2023 followed by electrical machinery ($85.55 billion) and nuclear reactors ($81.61 billion).

- Mexico becomes the biggest trade partner of the US, beating China

Mexico surpassed China after two decades to become the biggest export partner to the US in 2023.

- Mexico’s Exports to the US in Share Value

In 2023, Mexico exported and supplied around 79.6% of its goods to the US.

- Latest Trade Agreement between the US and Mexico

On July 1, 2020, the United States, Mexico, and Canada Agreement (USMCA) came into effect. Farmers, ranchers, employees, and companies in North America stand to gain greatly from the USMCA, which replaced the North America Free Trade Agreement (NAFTA).

Which countries export the most to the US in 2023?

In 2023, the US imports from the world saw a modest increase from the year before, despite a strong currency and a weak global economy. The biggest export partner of the US is Mexico. According to the latest statistics in 2023, the US imports from Mexico accounted for $480.08 billion. The mexico exports to us was increased by 5% in FY23 from the previous year.

- Mexico: $480.08 billion (up by 5%)

- China: $448.03 billion (down by 22%)

- Canada: $431.19 billion (down by 4%)

- Germany: $163.08 billion (up by 8%)

- Japan: $151.58 billion (down by 2%)

- South Korea: $119.72 billion (down by 1%)

- Vietnam: $118.94 (down by 12%)

- Taiwan: $89.91 billion (down by 6%)

- India: $87.28 billion (down by 4%)

- Ireland: $82.71 billion (up by 1%)

The Top Port Locations of US-Mexico Trade in 2023

In 2023, the ten port locations—four seaports, three airports, and three border crossings—accounted for little over 44% of all US trade with Mexico. Notably, 98% of Port Laredo's trade comes from Mexico, whose growth was slower than the city's. It raised its market share from 37% of total U.S.-Mexico trade to 39%, indicating that it did as projected. Examining the top seaports, airports, and border crossings in the country were:

- Port Laredo (up 7.1%)

- Port of Los Angeles (down 6.1%)

- Chicago’s O’Hare International Airport (down 5.7%)

- New York’s JFK International Airport (down 6.1%)

- Port of Houston (down 6.5%)

- Port of Newark (down 8.0%)

- Detroit’s Ambassador Bridge (up 7.5%)

- Los Angeles International Airport (down 13.6%)

- Port of Savannah (down 13.1%)

- Port Huron Blue Water Bridge (down 0.8%)

Mexico Exports More to the US than China After Two Decades

For the very first time in 20 years, Mexico exported more goods to the US in 2023 than China, demonstrating how drastically patterns of international commerce have changed. After stepping down as director general of Caterpillar in Mexico in 2021, Mr. Villarreal started fostering relationships with businesses aiming to relocate their manufacturing operations from China to Mexico. Hisun, a Chinese manufacturer of all-terrain vehicles, was one of his clients. Mr. Villarreal was engaged by Hisun to set up a $152 million production facility in Saltillo, a major industrial center in northern Mexico. This marks a turning point in the US-Mexico trade relations and has wide-ranging implications for both countries and the global economy.

How did Mexico beat China and become the biggest US Import Partner: A statistical comparison

For numerous reasons, including the continuing trade difficulties between the US and China, Mr. Villarreal claimed that foreign companies, especially the ones trying to sell in North America, took into consideration Mexico as an aggressive choice for China.

- Mexico exceeded China for the first time in the last 2 decades to emerge as the United States' largest authentic import supplier.

- This dramatic trade in the status of trade flows is a result of developing tensions between Washington and Beijing.

- According to facts, the trade hole between the US and China shrank dramatically with items imports from the kingdom falling by way of 20% to $427.2 billion.

- The United States average items and offerings trade imbalance, which is calculated as exports much less imports, decreased to 18.7%.

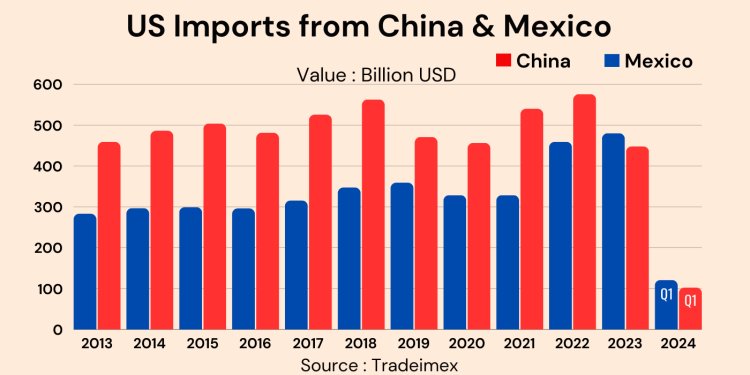

Mexico & China Exports to the US in the Last 10 Years

The US imports from China accounted for $448.03 billion while Mexico's exports to the US had a total value of $480.08 billion in 2023. This data shows that Mexico surpassed China as the biggest import partner of the US in 2023 in the last two decades. In the first quarter of 2024, US imports from Mexico had a total value of $120.94 billion, while US imports from China accounted for $102.7 billion. Let’s have a look at the statistical comparison of the US trade with Mexico and China in the last 10 years, and how Mexico became the biggest US import partner beating China in 2023 and 2024 (quarter one):

|

Year of Trade |

China Exports to US |

Mexico exports to US |

|

2013 |

$459.10 billion |

$283.13 billion |

|

2014 |

$486.29 billion |

$296.85 billion |

|

2015 |

$504.04 billion |

$299.22 billion |

|

2016 |

$481.36 billion |

$296.22 billion |

|

2017 |

$525.74 billion |

$315.60 billion |

|

2018 |

$562.70 billion |

$347.33 billion |

|

2019 |

$470.95 billion |

$359.33 billion |

|

2020 |

$456.44 billion |

$328.68 billion |

|

2021 |

$540.07 billion |

$388.31 billion |

|

2022 |

$575.71 billion |

$459.20 billion |

|

2023 |

$448.03 billion |

$480.08 billion |

|

2024 (quarter 1) |

$102.7 billion |

$120.94 billion |

US-Mexico Trade Nears Historic $800 Billion Mark Surpassing China's 2018 Figures

Trade between the United States and Mexico totaled $798.83 billion in 2023, falling short of the $817.36 billion in commerce between the United States and China in 2018. Even with a modest rise in trade this year, the United States would only be the second nation with whom it has ever done over $800 billion in two-way commerce. That would be Mexico. As in previous years, 42.1% of the $5.1 trillion total came from Mexico, Canada, and third-placed China. For the first time since 2020, commerce with China fell below $600 billion. The top ten made up 64.7% of all trade in the United States.

Conclusion

The shift in trade patterns, with the US importing more goods from Mexico than China for the first time in many years, is a considerable development with far-reaching implications. Mexico-America trade continues to grow under full pressure. It underscores the evolving nature of worldwide trade partners and the want for international locations to adapt to changing monetary realities. By seizing the possibilities and efficiently managing the demanding situations, America and Mexico can build a more potent alternate partnership that benefits both countries and contributes to the stability and increase of the worldwide economy.

What's Your Reaction?