Coal Exports Statistics 2023

Discover the latest insights on global coal trade with the most comprehensive Coal export Statistics for 2023. Indonesia is the biggest exporter of coal with a total export value of $104.30 billion in 2023. Dive deep into coal export trends, analysis, and forecasts in the coal market.

Introduction

As the global energy call for maintains to rise, coal continues to play a giant function in meeting this demand. Understanding the export data of coal can provide treasured insights into which international locations are main in each production and consumption. The Harmonized System Code or HS Code for coal is 2701. It is a standardized code used globally to classify and categorize this valuable commodity for international trade purposes. As an essential component of the energy industry, coal is given the HS Code of 2701. Global coal exports have been anticipated to have peaked at approximately 1,466 million metric tons in 2023. Asia has grown to be the middle of worldwide trade, accounting for 83% of imports to the Asia Pacific region. The coal trade is still transferring eastward on a worldwide scale. Even though the coal alternate has traditionally been focused within the Pacific and Atlantic basins, non-stop losses in European demand in addition to growing calls from India, Pakistan, and Bangladesh have caused larger volumes to be carried throughout the Indian Ocean than inside the Atlantic Basin. Approximately 78% of overall exports are going to Asia Pacific countries. In this article, we will delve into the coal export statistics of 2023, exploring the main exporters, and the top coal manufacturers at the global level along with the major trends in coal exports.

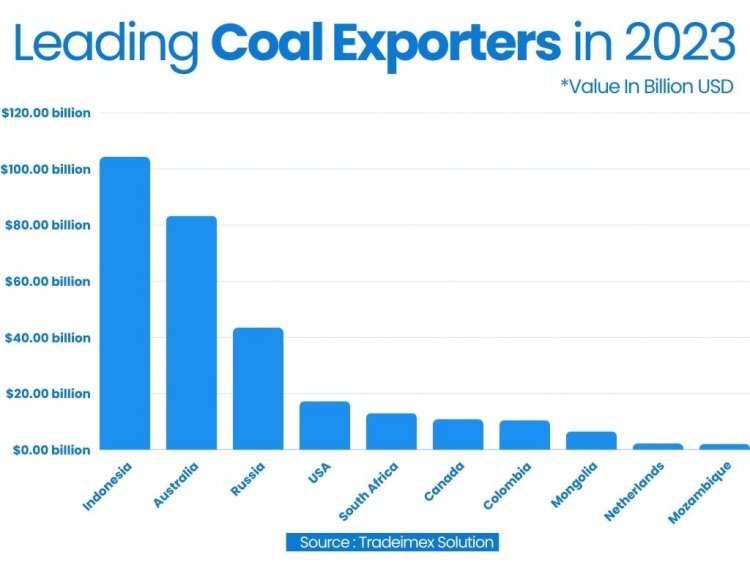

Who is the biggest Exporter of Coal in 2023?

Indonesia is the biggest exporter of coal with a total export value of $104.30 billion in 2023. As we analyze the coal exchange import-export information of 2023, it's miles vital to become aware of the main exporters of coal during that length. The facts known that the following countries stood out as the major coal exporters:

- Indonesia ($104.30 billion)

- Australia: ($83.30 billion) 33.7%

- Russia: ($43.45 billion) 17.6%

- USA: ($17.26 billion) 7%

- South Africa: ($13.03 billion) 5.3%

- Canada: ($10.79 billion) 4.4%

- Colombia: (10.50 billion) 4.2%

- Mongolia: ($6.51 billion) 2.6%

- Netherlands: ($2.18 billion) 0.9%

- Mozambique: ($2.03 billion) 0.8%

Who is the main supplier of coal?

As of January 2024, China Shenhua Energy had the highest market capitalization of any coal-supplying firm in the world, with a value of around $90.61 billion. Having a market valuation of approximately $69.66 billion at the time, the second-placed global coal-supplying corporation on this list is Glencore, based in Switzerland and having coal mining as part of its portfolio. Beyond nations, precise companies play a vital function in the international coal trade. Now the question arises “Who are the world's largest coal supplying companies for the trading market?” So, the top 10 coal suppliers in the world along with their annual turnover are:

- China Shenhua Energy Co. (China): $90.61 billion

- Glencore (Switzerland): $69.66 billion

- Coal India (India): $28.6 billion

- Yankuang Energy (China): $19.57 billion

- Washington H. Soul Pattinson and Company (Australia): $7.91 billion

- United Tractors (Indonesia): $5.77 billion

- Adaro Energy (Indonesia): $4.98 billion

- Alpha metallurgical resources (USA): $4.88 billion

- Yancoal (Australia): $4.68 billion

- Warrior met Coal Inc. (USA): $3.3 billion

Who are the biggest coal producers in the world?

China is the world's largest producer of coal by a wide margin. More than 52% of the coal produced globally was produced in China in 2023. The top 10 producers of coal in the world include:

- China: 3,708,155,408,000 (Metric tons)

- India: 761,662,038,400 (Metric tons)

- United States: 728,364,498,000 (Metric tons)

- Australia: 554,763,962,900 (Metric tons)

- Indonesia: 502,653,360,000 (Metric tons)

- Russia: 423,095,348,300 (Metric tons)

- South Africa: 277,951,564,100 (Metric tons)

- Germany: 193,593,193,800 (Metric tons)

- Poland: 143,996,028,700 (Metric tons)

- Kazakhstan: 113,619,500,900 (Metric tons)

Why are coal exports increasing?

Coal exports are increasing due to a combination of factors, including rising demand from countries such as China and India, where coal remains a significant part of their energy mix. Additionally, fluctuations in global coal prices and favorable exchange rates have boosted the competitiveness of coal exports from certain regions. Furthermore, infrastructure developments in exporting countries have facilitated the transportation of coal to international markets, further contributing to the upward trend in coal exports. This overall growth in coal exports is reshaping the dynamics of the global energy market and driving opportunities for coal-producing nations to capitalize on the surging demand for this fossil fuel.

The swift revival of the world economy in 2021 resulted in a significant surge in the demand for coal, which in numerous nations necessitated increased supply. The amount of coal traded internationally grew by 4 Mt (+1.3%) and 43 Mt (+4.3%) for metallurgical and thermal coal, respectively. The most adaptable is Indonesia, which is also the largest exporter of thermal coal worldwide in 2023.

What are the types of coal offered by the market?

The four primary categories, or ranks, of coal, are lignite, bituminous, subbituminous, and anthracite. The types and concentrations of carbon that coal contains, as well as the quantity of heat energy that the coal can create, determine its ranking. The market is segmented into the following product categories, which together made up the majority of the coal trading market in 2023:

- Lignite Coal: Lignite coal, additionally referred to as brown coal, is the bottom rank of coal, in terms of carbon content material and electricity price. Usually, it is used to generate power and as a heating fuel.

- Anthracite coal: Among all coal categories, anthracite typically has the highest heating value and includes 86%–97% carbon. In 2022, anthracite made for less than 1% of the coal mined. The metals sector is the primary user of anthracite coal.

- Bituminous coal: Between 45% and 86% of bituminous coal is carbon. In the United States, bituminous coal dates back 100–300 million years. The most common type of coal in the country is bituminous coal, which produced over 46% of all coal produced in the country in 2022. In addition to being a crucial fuel and raw material for the production of coking coal for the iron and steel industries, bituminous coal is used to generate power.

- Subbituminous coal: Usually containing between 35 and 45% carbon, subbituminous coal has a lower heating value than bituminous coal. In the global coal market, the majority of subbituminous coal is at least 100 million years old.

Who trades the most coal to the United States?

The United States, being certainly one of the largest customers of coal, is based on imports to supplement its home production. In 2023, the use of receiving the maximum coal exports from the United States is India. India's energy demands, as discussed in advance, make it a good-sized participant in the worldwide coal alternate, with a high-quality recognition on uploading coal from the USA to satisfy its developing desires.

Which areas are driving the market for coal trading?

Several specific areas are driving the market for coal trading, these areas include - Countries in North America (Canada, Mexico, and the United States), European countries (France, Russia, Germany, Italy, and the UK), Asia-Pacific countries (Malaysia, Vietnam, Thailand, Indonesia, Australia, China, Japan, Korea, and India), South American Countries (including Argentina, Brazil, and Columbia), and Countries in Africa and the Middle East (South Africa, Saudi Arabia, the UAE, Egypt, and Nigeria).

The future of global coal trade

The destiny and future of the global coal trade are full of large uncertainties and demanding situations. As the world grapples with the urgent need to transition in the direction of cleaner and extra-sustainable electricity assets, the destiny of the coal alternate stays unsure. Several factors are at play, which include environmental concerns, policy adjustments, and shifts in global strength markets. Increasingly stringent rules on emissions and the rising recognition of renewable strength options have led to a decline in coal consumption in a few regions. By the end of 2024, coal call is predicted to climb via 8% in India and 5% in China, while its miles are anticipated to say no via 20% within the US and the EU. Even whilst production of coal reached a record excessive these 12 months, by way of 2026, the call for coal is expected to fall globally.

Additionally, as nations make strides towards decarbonization, coal-dependent industries are being forced to adapt or face obsolescence. However, it's miles crucial to word that coal still performs a crucial role in the energy mix of many growing countries, in which it is seen as a greater, less expensive, and dependable source of electricity. As a result, the destiny of the global coal trade is probable to be characterized by way of a balancing act between the want to reduce greenhouse gasoline emissions and the call for lower-priced strength in certain elements of the sector. Adaptation, innovation, and collaboration among nations may be key in shaping the destiny of world coal trade.

Conclusion

In conclusion, the 2023 coal export projections provide valuable insights into the global coal conversion evolution. Indonesia and Australia are the largest exporters of Coal in 2023. Coal India Limited stands as the largest coal exporter company in the world, reflecting its dominance in the industry. Moreover, India leads the trade of coal from the US. Furthermore, a meticulous exam of this information enables stakeholders to assess the environmental impact of coal intake, thereby informing sustainable strength techniques for the future. As the world continues to grapple with the demanding situation of transitioning to purifier power sources, analyzing coal export statistics for 2023 serves as a basis for developing effective guidelines and techniques toward a more sustainable destiny.

Also Read Our Latest Blogs :-

US Soybean Exports Statistics 2023

Switzerland Gold Trade Import-Export Statistics of 2023

Corn exports and imports in 2023

Rice Import-Export Trade Statistics of 2023

What's Your Reaction?