Can Bangladesh Overtake China in the EU in Apparel Export?

China’s apparel exports to the EU accounted for $30.9 billion, while Bangladesh was just behind with $23.6 billion in 2023. Discover the potential of Bangladesh to overtake China in apparel trade with the EU. Explore the growth of EU apparel Exports and how Bangladesh is positioned to become the largest apparel exporter in the world along with a formidable competitor in the global textile industry.

The rise of Bangladesh as a formidable contender to China in the EU apparel trade.

The global apparel trade has long been dominated by China, but in recent years, Bangladesh has emerged as a strong contender in the European Union (EU) market. With its competitive advantages and increasing investments in the apparel industry, Bangladesh has the potential to overtake China in the EU apparel trade. The country has witnessed a significant rise in its apparel and cloth import assiduity and is poised to further strengthen its position in the EU request by 2023. The previous year saw China leading consistently in its apparel exports, with the total export value accounting for $234 billion in 2022, while Bangladesh exported apparel worth $223 billion in the previous year. This composition will bandy the rise of Bangladesh, its apparel and vesture import protrusions for 2023, the growth of vesture exports in the EU, and the future of the apparel assiduity in this region.

The Rise of Bangladesh in Apparel export

Over the past decade, Bangladesh has experienced significant growth in its apparel industry. The country has become one of the largest exporters of garments in the world. With its low labor costs, large workforce, and favorable trade agreements, Bangladesh has attracted investments from international clothing brands.

Bangladesh Clothing Export Projections for 2023

According to industry experts, Bangladesh's clothing exports are expected to reach new heights by 2023. With the implementation of sustainable practices and improved production efficiency, the country aims to export garments worth $50 billion annually. This projection showcases the ambitious growth plans of Bangladesh in the apparel trade.

Growth of Apparel Exports in the EU

In recent years, the EU has witnessed a gradual shift in its apparel imports. While China still dominates the market, Bangladesh has shown remarkable progress. Bangladesh's apparel exports to the EU have been growing at an annual rate of around 10%.

EU Apparel Exports

Apart from being importers, several EU countries have also established themselves as apparel exporters. Countries like Germany, Italy, and Spain are renowned for their high-quality apparel and fashion industry. The EU enjoys a strong supply chain and infrastructure, which benefits its clothing exports.

What is the future of the Apparel Industry in the EU?

With the rise of Bangladesh, the future of the apparel industry in the EU looks promising. As these countries continue to invest in modernizing their production facilities and improving their product quality, they will be better equipped to meet the demands of the European market. Additionally, the EU's focus on sustainable and ethical fashion practices presents an opportunity for Bangladesh to showcase its commitment to responsible manufacturing and come out as a fierce competitor to China. The EU also cautioned against importing too many apparels from China and Bangladesh as the trade deficit widens.

As imports from China and Bangladesh rose, EU trade in apparel saw record growth in 2023, surpassing €200 billion (US$216 billion) for the first time. Industry trade associations have warned that the growing trade deficit is concerning.

Which country is the largest apparel exporter in the world?

China has been the world's top exporter of clothing for a considerable amount of time. The top 10 Garment and Apparel Export Countries for 2023 are:

- China: ($286 billion)

- Bangladesh: ($46.2 billion)

- Vietnam: ($43.7 billion)

- India: ($41.4 billion)

- Germany: ($40.4 billion)

- Turkey: ($35.7 billion)

- Italy: ($35.4 billion)

- United States: ($24.6 billion)

- Spain: ($20.2 billion)

- Pakistan: ($19.2 billion)

Factors that propel the Apparel and clothing export sector

The exports of clothing and apparel industries in these nations are driven by several variables.

- Low wage costs: Producing clothing is less expensive in many nations due to low labor expenses.

- Availability of raw materials: Cotton and wool, two commodities used by the apparel sector, are readily available in many nations.

- Government measures that are advantageous to garment exporters: Many governments provide subsidies and tax breaks to garment exporters.

- Robust Infrastructure: Accessing markets for clothing and accessories is facilitated by well-maintained roads, ports, and other infrastructure.

- Competing skills: The workers can manufacture high-quality clothing because they are frequently skilled in the garment production process.

How Can Bangladesh Overtake China in the EU in Apparel Trade?

- Focus on Quality and Compliance: Bangladesh must prioritize maintaining the quality of its apparel exports while adhering to international compliance standards. By consistently delivering high-quality products, they can win the trust and loyalty of European buyers.

- Efficient Supply Chain Management: Streamlining their supply chain processes will enable Bangladesh to ensure timely deliveries and responsiveness to buyer demands. By investing in infrastructure and technology, they can optimize efficiency and stay competitive.

- Invest in Sustainable Practices: Sustainability has become a significant factor influencing consumer choices. By adopting eco-friendly manufacturing processes, Bangladesh can attract environmentally conscious consumers and gain a competitive edge.

- Market Diversification: Bangladesh should explore opportunities beyond its traditional markets in the EU. By expanding its customer base and exploring newer markets, it can reduce its dependency on a single region and mitigate risks associated with market fluctuations.

- Developing Design Capabilities: Investing in design capabilities and innovation is crucial to differentiate themselves in the EU market. By blending creativity and cultural influences, it can cater to the diverse tastes and preferences of European consumers.

Bangladesh and China’s exports of Apparel to EU in 2023

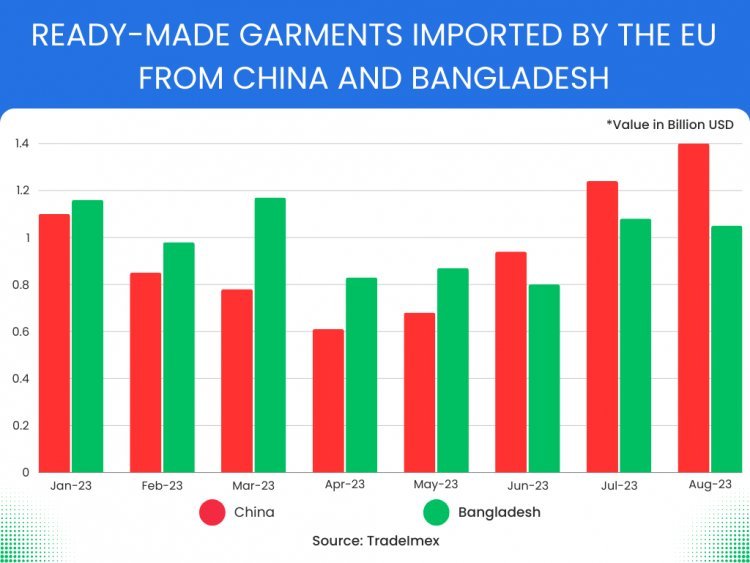

Here is a Comparative Analysis of Bangladesh and China’s exports of Apparel to EU in 2023 as China overtook Bangladesh from June 2023 to August 2023, while Bangladesh was consistently leading in apparel exports for the first 5 months of 2023. (value In Billion USD)

|

Export Country |

Jan-23 |

Feb-23 |

Mar-23 |

Apr-23 |

May-23 |

Jun-23 |

Jul-23 |

Aug-23 |

|

China |

$1.1 |

$0.85 |

$0.78 |

$0.61 |

$0.68 |

$0.94 |

$1.24 |

$1.4 |

|

Bangladesh |

$1.16 |

$0.98 |

$1.17 |

$0.83 |

$0.87 |

$0.8 |

$1.08 |

$1.05 |

China was the largest apparel exporter in the EU from June 2023 to August 2023, While Bangladesh maintained its position as the largest apparel exporter from January 2023 to May 2023.

Which countries are the top apparel exporters in the EU?

Based on the EU trade data for 2023, the following are the top 10 apparel exporters in the EU:

- China: $30.93 billion (15%)

- Bangladesh: $23.60 billion (11.5%)

- Turkey: $12.29 billion (6.0%)

- India: $4.96 billion (2.4%)

- Vietnam: $4.74billion (2.3%)

- Pakistan: $3.99 billion (2.0%)

- Cambodia: $3.88 billion (1.9%)

- Myanmar: $3.34 billion (1.6%)

- Morocco: $3.13 billion (1.5%)

- Tunisia: $2.37 billion (1.2%)

Conclusion

While China has had a stronghold in the EU apparel trade, Bangladesh is gradually challenging its dominance. With its competitive advantages, including low labor costs, a skilled workforce, and favorable trade agreements, Bangladesh has positioned itself as a strong contender. As it continues to invest in its apparel industries and improve its production capabilities, Bangladesh has the potential to overtake China in the EU apparel trade by 2023-24. The future of the apparel industry in the EU looks promising, with increased diversity in supply sources and the emergence of new players in the market. Time will tell if Bangladesh can indeed become the next powerhouse in the EU apparel trade and the global apparel industry.

Read More:-

Medical Equipment Exports in 2022

top electronic exports of the Philippines

What's Your Reaction?