Brazil’s Role in Global Ores, Slag, and Ash Import & Export: Insights, Challenges, and Opportunities

Explore Brazil's role in Ores, Slag, and Ash imports and exports for global trade. Brazil's exports of ores, slag, and ash totaled $35.05 billion, while Brazil's ores, slag, and ash imports were valued at $760.09 million in 2023.

Brazil has played a significant role in the global ore, slag, and ash market. With its abundant natural resources and strategic location, the country has become a key player in the import and export of Ores, Slag, and Ash. According to Brazil's import data for ores, slag, and ash, Brazil’s imports accounted for $760.09 million in 2023, while Brazil’s export of ores, slag, and ash totaled $35.05 billion according to Brazil export data for 2023. The two-digit HS code for ores, slag, and ash is 26. In this article, we will explore the insights, challenges, and opportunities that Brazil faces in this dynamic sector.

Overview of Brazil’s Ores, Slag, and Ash Industry

Brazil is known for its rich deposits of iron ore, which is a major component of steel production. The country also produces significant amounts of copper, bauxite, and other minerals used in various industries. In addition, Brazil is a major producer of slag and ash, which are byproducts of the metal smelting process.

The mining and processing of ores, slag, and ash contribute substantially to Brazil’s economy, providing employment and revenue for the country. The country’s strategic location in South America also allows for easy access to international markets, making it a preferred supplier for many countries around the world.

Insights into Brazil’s Import and Export Trends for Ores, Slag, and Ash

Brazil is one of the largest exporters of iron ore in the world, with major markets in China, Europe, and the United States. The country also imports certain minerals and metals to meet domestic demand and supplement its production capacity. Overall, Brazil has a positive trade balance in ores, slag, and ash, making it a key player in the global market. In recent years, Brazil has faced challenges such as fluctuating commodity prices, regulatory changes, and environmental concerns. These factors have affected the country’s export volumes and revenue, prompting the government and industry players to adopt new strategies to maintain competitiveness in the global market.

Where does Brazil import ores, slag, and ash from? | Brazil import data by Country

Brazil Imports the most ores, slag, and ash from Chile ($358.85 million), followed by Peru and China. The top 10 countries from which Brazil import the most ores, slag, and ash according to the Brazil shipment data and Brazil customs data in 2023 are:

- Chile: $358.85 million

- Peru: $182.30 million

- China: $55.89 million

- USA: $44.26 million

- South Africa: $40.43 million

- India: $40.26 million

- Netherlands: $10.74 million

- Australia: $3.32 million

- Singapore: $2.85 million

- Madagascar: $2.64 million

Major varieties of ores, slag, and ash imported by Brazil | Brazil Import Data by HS Code

Brazil imports a wide range and varieties of ores, slag, and ash from around the world. The major types of ores, slag, and ash imports from Brazil according to Brazil trade data and Brazil Buyers data in 2023 include:

- Molybdenum ores and concentrates (HS code 2613): $340.92 million

- Zinc ores and concentrates (HS code 2608): $178.94 million

- Copper ores and concentrates (HS code 2603): $105.10 million

- Iron ore and concentrates (HS code 2601): $74.03 million

- Niobium, tantalum, or zirconium ores & concentrates (HS code 2615): $31.50 million

- Titanium ores and concentrates (HS code 2614): $15.85 million

- Chromium ores and concentrates (HS code 2610): $5.30 million

- Aluminum ores and concentrates (HS code 2606): $2.83 million

- Tin ores and concentrates (HS code 2609): $2.01 million

- Manganese ores and concentrates (HS code 2602): $1.65 million

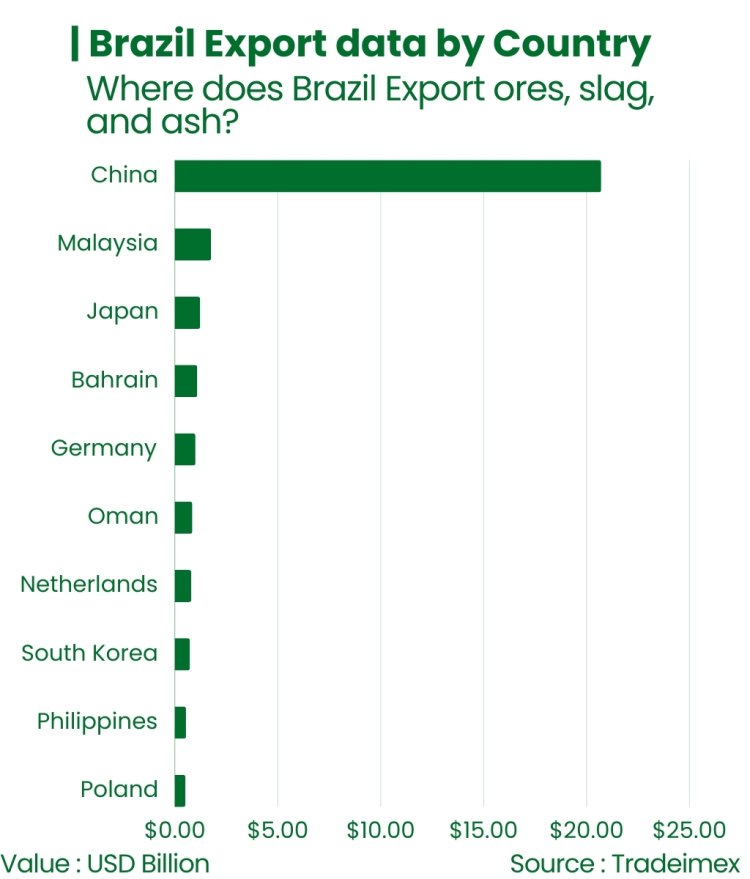

Where does Brazil Export ores, slag, and ash? | Brazil Export Data by country

Brazil exports the most ores, slag, and ash to China worth $20.71 billion in 2023, followed by Malaysia and Japan. The top 10 countries that import the most ores, slag, and ash from Brazil in 2023 according to Brazil export data and Brazil trade statistics are:

- China: $20.71 billion

- Malaysia: $1.76 billion

- Japan: $1.23 billion

- Bahrain: $1.09 billion

- Germany: $1 billion

- Oman: $849.49 million

- Netherlands: $796.04 million

- South Korea: $730.85 million

- Philippines: $541 million

- Poland: $512.04 million

What are the major varieties of ores, slag, and ash exported by Brazil? | Brazil Export Data by HS Code

Brazil exports a huge number of ores, slag, and ash annually, as one of the top ore exporters in the world. Brazil’s top 10 varieties of ores, slag, and ash exports in 2023 according to Brazil trade data and Brazil export data are:

- Iron ores and concentrates (HS code 2601): $30.59 billion

- Copper ores and concentrates (HS code 2603): $3.46 billion

- Precious metal ores and concentrates (HS code 2616): $274.39 million

- Nickel ores and concentrates (HS code 2604): $244.45 million

- Aluminum ores and concentrates (HS code 2606): $175.55 million

- Manganese ores and concentrates (HS code 2602): $142.96 million

- Niobium, tantalum, or zirconium ores & concentrates (HS code 2615): $45.41 million

- Lead ores and concentrates (HS code 2607): $37.77 million

- Zinc ores and concentrates (HS code 2608): $15.20 million

- Tin ores and concentrates (HS code 2609): $15.17 million

Challenges Faced by Brazil in Ores, Slag, and Ash Trade

Despite its strong position in the global market, Brazil faces several challenges in the trade of ores, slag, and ash. One of the key challenges is the volatility of commodity prices, which can have an impact on the country’s export earnings and revenue. In addition, regulatory changes in importing countries and geopolitical tensions can also affect Brazil’s trade relationships and market access.

Environmental concerns related to mining and processing activities are another major challenge for Brazil. The country has faced criticism for its impact on the environment, leading to stricter regulations and compliance requirements. This has increased the cost of production and added complexity to the trade of ores, slag, and ash.

Opportunities for Growth and Expansion

Despite the challenges, Brazil’s ores, slag, and ash sectors present numerous opportunities for growth and expansion. The country’s vast reserves of natural resources provide a competitive advantage in the global market, attracting investment and partnership opportunities from international players.

Brazil can also leverage its strategic location and trade agreements to strengthen its position as a key player in the global market. By diversifying its product portfolio, exploring new markets, and investing in technology and innovation, Brazil can enhance its competitiveness and capitalize on the growing demand for ores, slag, and ash worldwide.

FAQs on Brazil’s Role in Global Ores, Slag, and Ash Import & Export

- What are Brazil's primary exports in the ores, slag, and ash sector?

Brazil is a leading exporter of various ores, with the top export being iron ores and concentrates, contributing approximately $30.59 billion in 2023, based on Brazil trade data and trade statistics. Other significant exports include copper ores, precious metal ores, and manganese ores, among others.

- Which countries are Brazil’s main export partners for ores, slag, and ash?

In 2023, Brazil's largest export market for ores, slag, and ash was China, accounting for $20.71 billion. Other key export partners included Malaysia, Japan, and Germany.

- How does Brazil's import activity in ores, slag, and ash as compared to its exports?

Brazil maintains a positive trade balance in the sector, being predominantly an exporter. While it imports various ores and concentrates—primarily from Chile, Peru, and China—the scale of its exports significantly outweighs its imports.

- What challenges does Brazil face in the ores, slag, and ash market?

Brazil faces several challenges, including:

- Commodity Price Volatility: Fluctuations in prices can directly influence export revenues.

- Environmental Regulations: Stricter mining regulations can increase production costs and complicate operations.

- Global Geopolitical Tensions: Changes in trade policies and tensions can impact market access and relationships.

- What types of ores, slag, and ash do Brazil import?

Brazil imports a variety of ores, slag, and ash, with significant imports including molybdenum, zinc, and copper ores. For instance, molybdenum ores and concentrates alone comprised $340.92 million of imports in 2023 according to Brazil shipment data.

Conclusion

Brazil’s role in the global trade of ores, slag, and ash is pivotal to the country’s economy and the international trade market. With insights into the industry trends, challenges faced, and growth opportunities, Brazil can navigate the dynamic landscape of the commodities sector and secure its position as a leading supplier of essential minerals and metals as per Brazil Suppliers data. Brazil’s rich natural resources, strategic advantages, and commitment to sustainable practices position the country for continued success in the global ores, slag, and ash market.

What's Your Reaction?